FrontView REIT (NYSE: FVR)

Busted outparcel net lease REIT IPO now trading at a 9.5% cap rate, 7.5% dividend yield, and 25% discount to estimated net asset value.

Summary

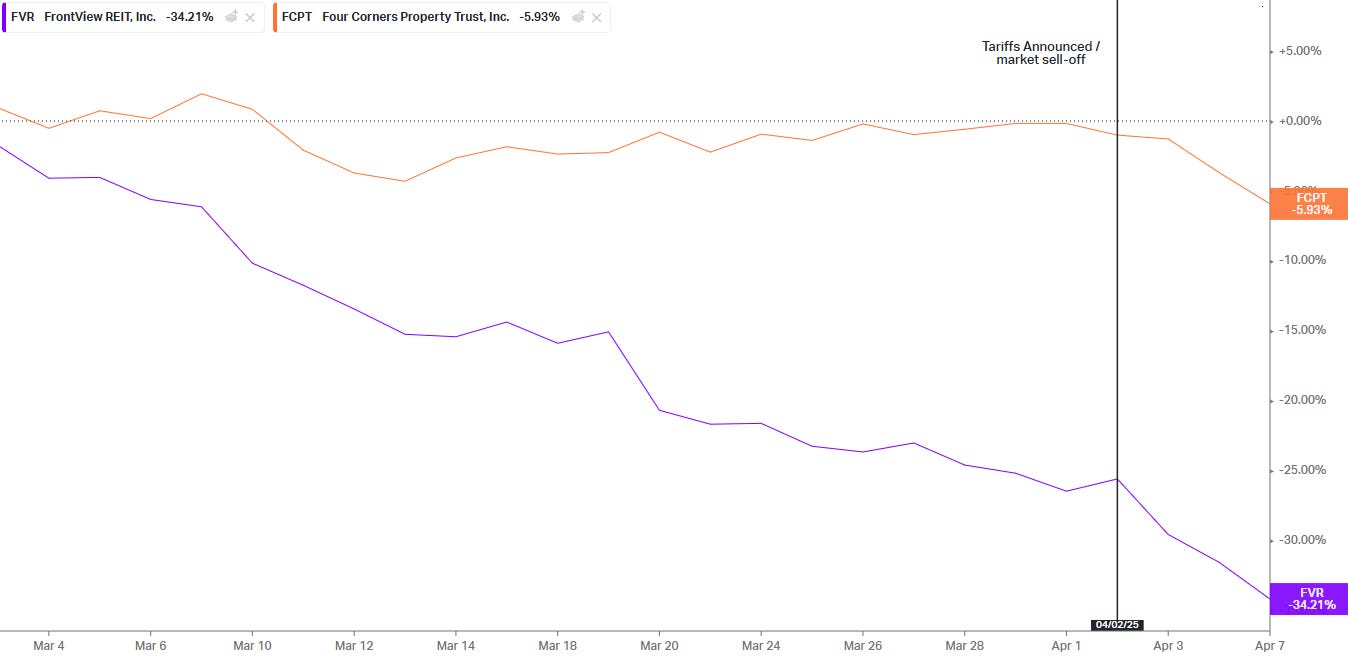

Busted October 2024 IPO with 35%+ sell-off since March 2025 triggered by tenant credit issues and exacerbated by lock-up ending for investors in the predecessor entity, a private REIT.

Owns outparcel, net lease real estate diversified across locations, industries, and tenants focused on predominantly necessity and discount retail, services, and food & beverage sectors that are less economically sensitive.

Portfolio is 97.7% occupied with a 7.2 year lease term and have 1.7% annual rent escalators.

Trades at a 9.5% cap rate, 10.5x cash FFO, and pays a 7.5% dividend yield (~80% cash FFO payout ratio), representing an attractive discount to best peer Four Corners Property Trust (FCPT: ~6% cap rate, ~16x FFO, and ~5.2% dividend yield).

Trades at a 25% discount to NAV estimate based on an 8% cap rate with upside potential from replacing rent from tenants with credit issues (~4% of ABR) and debt-funded accretive acquisitions (~$55m closed or U/C in 2025 YTD at a 7.9% cap rate).

Insider purchases by Co-CEOs and Director at 15%-20% premium to current share price.

Background

Credit where it’s due: I first saw this idea posted by @PrivateEyeCap on twitter who also wrote a Seeking Alpha article on the company that provides a good overview of the business and valuation albeit I have not consulted their valuation work in doing my own analysis.

FrontView REIT owns net leased outparcel real estate. These are freestanding buildings typically located in and around existing shopping centers. FrontView’s strategy is to focus on outparcels with frontage - that have visibility and easy access from highly-trafficked roads. These properties are predominantly leased to dining, healthcare, and other service retail tenants.

Source: FrontView March 2025 Investor Presentation

FrontView IPO’d in October 2024 at $19 per share and while shares did OK through 2024 and into 2025, they’ve fallen off a cliff since March.

Source: Koyfin

The selloff began in earnest after the company revealed that they had taken back, or expected to take back, 12 properties representing 4% of ABR in their Q4 earnings on March 19th. Half of the impact was recognized as bad debt in Q4 with the remaining 200 bps to come in Q1 2025.

Credit issues are the bane of net lease real estate investors as they disrupt what are overwise very predictable cash flows and can result in losses if properties have to be sold vacant. These issues—and the fear that there could be more skeletons in the closet—resulted in a ~35% decline in the share price since March. Interestingly, the sell off intensified after the April 2nd tariff announcement that kicked off a US market correction, while the best public market peer, Four Corners Property Trust (Ticker: FCPT - more on this later), has been basically flat (down only ~5%) over the same period.

Source: Koyfin

Why now?

FrontView trades at an attractive valuation as shares have sold off indiscriminately in the current market downturn despite the fact that the net lease business model is stable and largely not economically sensitive.

One reason there are more sellers than buyers is that the lock-up period for certain investors in the private REIT predecessor entity ended on March 31, 2025. These investors owned ~45% of the REIT in the form of operating partnership units. Approximately 10% of the operating partnership units were converted to common shares in Q4 2024, a required first step before the shares can be sold. While volume has not spiked since the 31st, I believe many of these continuing investors will be selling now that liquidity is available, regardless of price.

In addition, FrontView is a small REIT with a <$350m market cap—it’s too small for most market participants to buy or care about. Furthermore, the fact that Four Corners Property Trust has a very similar portfolio, is better established after spinning out of Darden Restaurants in 2015, and is ~9x the size with a $2.8bn market cap means that is represents a more accessible way to access net lease outparcel real estate.

I believe FrontView is well-positioned in the current environment as while net lease real estate has limited internal growth prospects, the risk-reward is attractive today as:

Their tenants are predominantly necessity, discount or service-oriented and thus less economically sensitive than many other real estate sectors.

The portfolio weighted average lease term is long (>7yrs), which provides stability in NOI and cash flows. Occupiers typically also have lease extension options and tend to not vacate so long as the business remains solvent and they can trade profitably from the location in question.

The net lease business model limits both operational and capital expenditure, resulting in high cash conversion.

FrontView’s IPO also put their balance sheet in a solid position. Proceeds were used to reduce leverage to ~$270m as of Q4 2024 and ~5.5x net debt to EBITDA. Leverage is in the form of a $200m term loan and a $250m revolving credit facility, which has $70m drawn and $180m available. These facilities mature in October 2027 with two 1-year extension options and are priced at ~130bps over SOFR. In early March, they entered into an interest rate swap to fix the $200m term loan at 4.96%.

In at least a small vote of confidence, both Co-CEOs and a Director purchased ~$375k of shares March 21st - 25th at about $13.50 per share, a >15% premium to the current share price.

Portfolio

FrontView owns 307 properties comprising 2.4 million square feet leased to 150 different brands across 15 industries and 35 states. The portfolio is diversified with the top 10 tenants representing ~22% of rent and the top 5 states (Illinois, Texas, Georgia, North Carolina, and Ohio) representing ~40% of rent.

Source: FrontView March 2025 Investor Presentation

The largest industry is dining (casual dining and quick service restaurants) at ~30% of rent, followed by medical and dental providers (~15%) and general retail, financial institutions, and automotive stores and dealers each at ~10%. About one third of the portfolio is investment grade.

Source: FrontView March 2025 Investor Presentation

Valuation

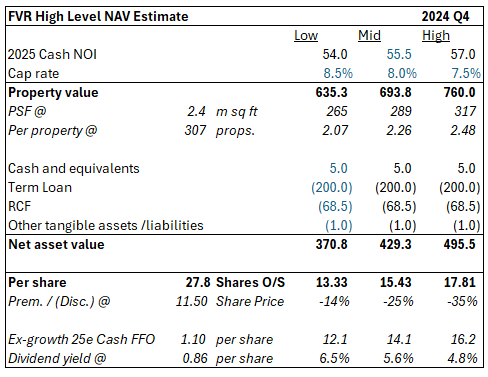

Based on a share price of $11.50, FrontView’s market capitalization is ~$325m and adding debt of ~$270m and deducting cash of ~$5m arrives at an enterprise value of $590m. I estimate that the portfolio owned at Q4 2024 will generate cash NOI of $55.5m and cash FFO ~$30m after ~$25m of G&A, interest, and other expenses. My NOI estimate accounts for 3% of bad debt in the year—2% from the known tenant issues and the high end of management guidance of an additional 1% for other potential issues throughout the year.

As a result, at $11.50 per share FrontView trades at an “ex-growth” (i.e. before factoring in external growth through acquisitions) implied cap rate of ~9.5% and a 10.5x cash FFO multiple. The portfolio is valued at $1.9m per property and ~$245 PSF.

I see at a ~25% discount to NAV of ~$15.45 per share based on an 8% cap rate. This would represent a ~14x “ex-growth” cash FFO multiple and result in a ~5.5% dividend yield.

This cap rate range looks reasonable given recent transactions:

In Q4 2024, FrontView acquired 29 new properties for $103.4 million at a weighted average cash capitalization rate of 7.9% and a weighted average lease term of 11 years.

Subsequent to quarter end they acquired 15 new properties for $37.9 million at a 7.8% cap rate and a weighted average lease term of 12.5 years and have an additional $18.2 million of properties under contract at a 8.2% cap rate.

Also subsequent to quarter end, they sold one property—a Freddy’s restaurant in Jacksonville—for $2m at a 6.9% cap rate. Worth noting that this was the one remaining Freddy’s they owned after the other went dark and is included in the 12 properties / 4% of ABR with credit issues.

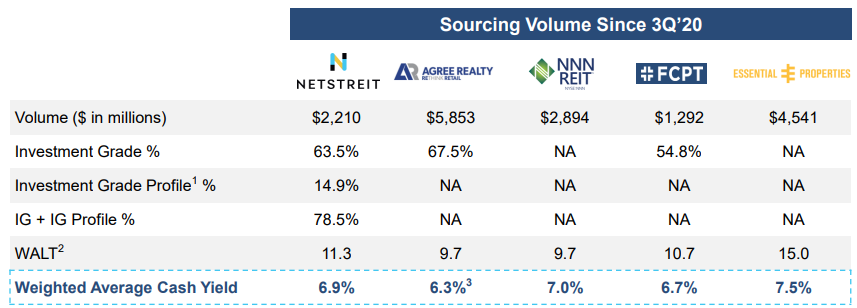

This cap rate range also looks reasonable looking at historical acquisition yields that averaged between 6.3% - 7.5% across a subset of net lease REITs since Q3 2020. This includes periods in which long-term rates were much lower than today but also includes the higher rate period since 2022.

Source: NETSTREIT March 2025 investor presentation

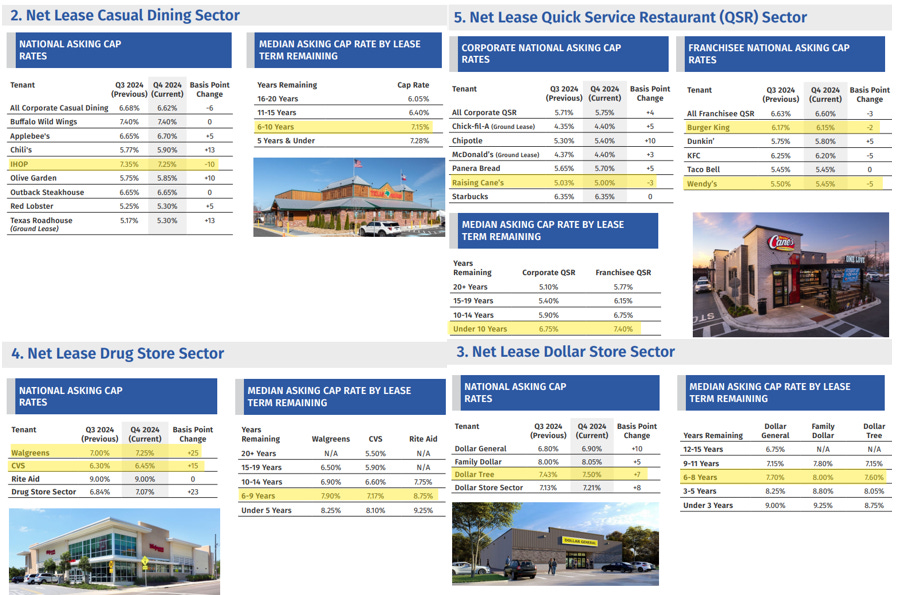

These cap rate ranges also look reasonable based on the the Boulder Group’s Q4 2024 net lease market report. They see retail net lease cap rates (blue line in chart below) reaching ~6.5% up c. 75 bps from the lows in early 2022. Looking at major FrontView tenants with lease terms <10 years, cap rates tend to be in the 7% - 8% range, even for sectors facing challenges (drug stores - CVS and Walgreens - and dollar stores).

Source: The Boulder Group Q4 2024 Net Lease Market Report

Peer comparison

There is one other REIT that focuses on outparcel net lease real estate, which is Four Corners Property Trust (FCPT). Based on a $27.25 share price, they trade at a 5.9% implied cap rate, $480 PSF, and a 16.1x cash FFO multiple. Their portfolio is similar to FrontView’s but has a higher investment grade tenancy (driven by their Darden tenant concentration), higher rent PSF, and a slightly lower contractual rent escalators.

FCPT’s dividend yield is 5.2% and they payout 84% of cash FFO compared to FrontView’s 7.5% yield with a 78% payout ratio.

I believe the FCPT portfolio is higher quality than FrontView’s as they’ve leveraged their lower cost of capital to acquire better assets at lower cap rates ($199m of properties acquired in the last 5 months of 2024 at a 7.1% cap rate). They’ve also earned a premium valuation in the public markets as they’ve maintained a low-leverage balance sheet and been judicious in only issuing equity when its cost allows for accretive growth. However, the current valuation differential is extreme and while I don’t think they should trade at parity, a 2x-3x cash FFO multiple premium and ~100 bps cap rate discount would feel like a more appropriate level.

Potential upside

Near-term upside to current NAV and valuation could come in two primary forms:

Re-lease or sell the 12 properties that were vacated by tenants over the last two quarters.

Accretive external growth through acquisitions.

Management highlighted they are in negotiations with 6 different users for the 12 assets that went dark in Q4 2024 including three properties that are under contract for sale, two properties that have letters of intent for sale, and one lease that is under negotiation. If the three properties under contract are sold and the proceeds are re-invested, management indicated that would represent about 1/3 of the 4% of lost ABR or ~$750k of cash NOI with the three assets with outstanding LOIs and leases under negotiation representing another ~17% of the 4% of lost ABR or $400k of cash NOI.

Converting these transactions has the potential to increase NAV by ~$0.50 per share based on an 8% cap rate (+3.4%) and increase cash FFO by $0.04 per share or ~3.8%. Management have indicated that the assets under contract could close and be reinvested in H1 2025.

FrontView also continues to see what they view as attractive acquisition opportunities and have ~$56m of properties closed or under contract in 2025 to-date at a 7.9% cap rate. Management guided to 2025 acquisitions of $175m - $200m at above a 7.5% cap rate. While equity issuance would be dilutive given the current share price, cost of debt on the remaining ~$180m of capacity on the revolving credit facility is ~5.7%, which suggests a spread of acquisition cap rate over cost of debt of ~200 bps. Assuming some incremental G&A related to these acquisitions, hitting the midpoint of their acquisition guidance could translate into ~$0.08 per share of FFO, a 7.3% increase.

Funding these acquisitions through debt is possible but would take their net debt to EBITDA to ~8x. Public market investors would view this as an unsustainable level (and management have guided to ~6x net debt to EBTIDA over the long-term vs. ~5.5x today) and would have to be addressed through subsequent asset sales and / or equity issuance.

A final potential upside point could be a decline in long-term rates, due to an economic downturn, or otherwise, which could result in lower cap rates for net lease properties, which are typically viewed as more stable and safe during a downturn (despite FrontView certainly not trading like it).

Key risks

Existing credit issues are the tip of the iceberg. FrontView has pursued a strategy in which they claim to have traded investment grade tenancy in favor of real estate quality. While they claim that the current tenant credit issues are an abnormal bubble, there is the risk that their underwriting has taken too much tenant credit risk and future NOI and FFO could be impacted.

Unfortunately, they do not disclose unit-level financials, which would provide a picture into the trading health of their tenants. Other net lease REITs do report this metric for their tenants that are required to report this information. For example, 66% of FCPT’s ABR reports unit-level financials and EBITDAR / rent coverage was ~4.9x at Q4 2024.

The company’s ability to address this current set of tenant issues by re-leasing or re-investing asset sales will be an important test case to assess the company’s portfolio quality and underwriting process.

Management pursues growth over shareholder value and issues dilutive equity to fund acquisitions. While debt-funded acquisitions are cash flow accretive, equity issuance to fund acquisitions would be dilutive to both NAV and cash flow per share. Small REITs do need to grow to scale into their largely fixed G&A costs but doing so through dilutive equity issuance is a major red flag and can result in the company trading at a perpetual discount to NAV. There are many examples of this in small-cap REIT-world.

FrontView released an update ahead of Q1 earnings next month:

-CFO leaving suddenly, been with company for <1yr, no quote, no statement that departure is not due to a disagreement with the company. Randall Starr to pick up CFO duties along with Co-CEO. Red flag and bears careful watching. Hope to get some commentary on this in Q1 results.

-Acquired ~$50m in Q1 at 7.9% cap, 12yr WALT, ~30% investment grade tenancy

-Post Q1 closed or U/C on ~$12m at >8% cap, ~10yr WALT

-Out of 12 properties called out for credit issues in Q4 earnings:

-6 are in sale / lease process (2 sales firm, 1 property leased)

-3 are open and rent paying (2 Hooters, JoAnne) - positive surprise

-3 actively marketing for sale / lease (no progress)

-Expect to recover 75% - 100% of ABR lost once efforts are complete

-Equivalent replacement income is expected to come back online in Q4 2025 or in early 2026.

-Due to credit issues occupancy rate at the end of Q1 2025 ticked down slightly to over 96%

-Enhancing disclosure of tenancies to top 40 from top 20 starting with Q1 results

On capital allocation: "Given the current cost of our capital, we plan to slow down our acquisition activity and evaluate acquisitions opportunistically, in order to prudently allocate capital."

Good to hear them signaling they will not grow at any cost. CFO leaving is a red flag as it could indicate bigger issues with the financials and/or company culture.