BSR REIT (TSX:HOM.U)

Texas triangle multifamily REIT listed in Toronto trading at a ~25% discount to NAV after transformational transaction that removes legacy investor consent rights and opens the door to M&A

Summary

Small-cap REIT (~$700m market cap) listed in Canada but owns US multifamily apartments primarily in the Texas Triangle (Austin, Dallas / Fort Worth, and Houston).

Owns 25 suburban, garden-style properties comprising ~6,800 units with an average age of 13 years with Houston as its largest market.

Sold a portfolio of Austin and Dallas properties representing ~1/3 of the REIT to AvalonBay for a ~5% cap rate and ~$230k per unit.

This is a transformative transaction, as it created a tax-efficient deal structure for operating partnership unitholders, in exchange for which they gave up consent rights on significant transactions, which opens the door for future M&A.

AvalonBay had originally approached BSR to acquire the entire entity with the tax needs of legacy investor OP unitholders being the limiting factor.

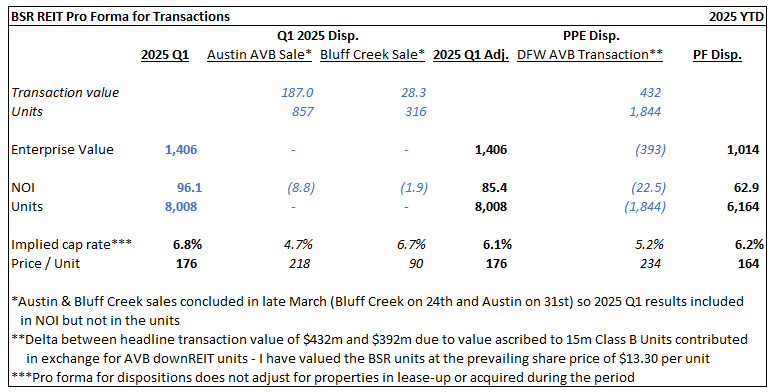

Adjusting for this transaction, which closed in April 2025, BSR REIT trades at an implied cap rate of ~6.2% and ~$165k per unit.

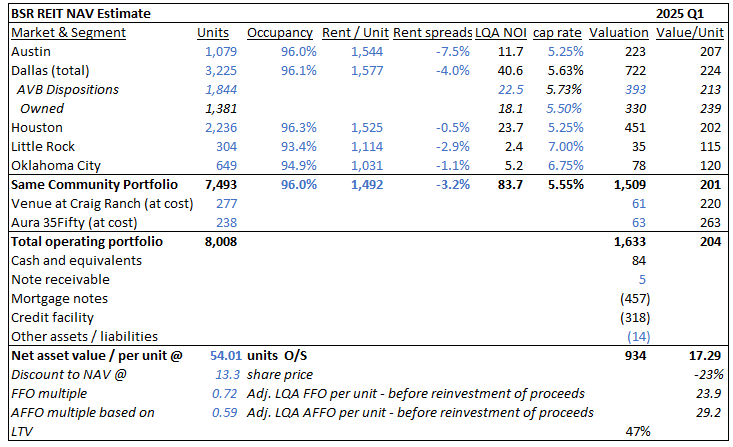

I estimate that at $13.30 per share, BSR trades at a 23% discount to NAV of $17.30 per share based on a ~5.5% cap rate, which represents ~$205k per unit, which represents an attractive cost basis for M&A or a take private transaction.

Background

BSR REIT listed on the Toronto Stock Exchange in 2018 but has its origins in two family-run US apartment businesses, Bailey Properties and Summit Housing Partners that merged in 2012.

Despite being listed north of the border, it is focused on multifamily apartment properties in the US sunbelt. The decision to list on the TSX was due to its small size. The costs associated with a public listing are lower on the TSX vs. major US exchanges and the hope was that due to the smaller size of the Canadian listed market, the REIT would get better banking and analyst coverage, which would at least in theory, result in a better valuation for the REIT’s units.

BSR REIT’s portfolio consists of 24 operating properties and 1 recently completed development in Austin that is in lease-up. They own suburban, garden-style apartments with an average age of 13 years.

Why Now?

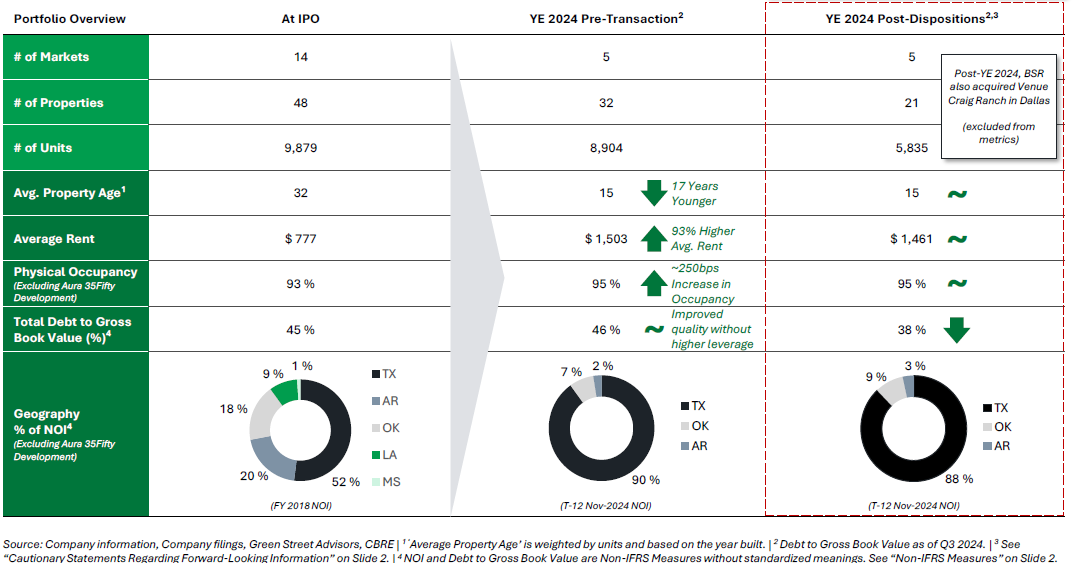

BSR REIT has upgraded its portfolio significantly since its IPO. What started as a diversified mix of Class A through Class B/C properties located in primary, secondary, and tertiary markets in Texas, Arkansas, Oklahoma, Louisiana, and Mississippi has increasingly focused on Class A / B+ properties in the Texas Triangle markets of Austin, Dallas / Fort Worth, and Houston.

The first phase of portfolio repositioning took place after their IPO through 2021 when they capitalized on a strong market for sunbelt multifamily properties, which compressed the spread between cap rates for secondary markets / Class B (and lower) properties and Class A properties in primary markets, to recycle capital out of older, lower-quality assets in secondary markets into newer, modern assets in their target Texas Triangle markets.

BSR REIT portfolio rotation since 2018 IPO

Source: BSR REIT / AvalonBay Transaction Presentation, February 2025

Since 2022, rising interest rates and a wave of new supply across the US sunbelt multifamily markets have weighed on operating performance, asset values, and the stock price. A higher cost of capital has meant that external growth through acquisitions had to be put on the back burner.

Despite this challenging environment, BSR recently found a way to access low-cost capital to fund the next phase of recycling capital into higher-quality assets in its target markets.

Transformational transaction

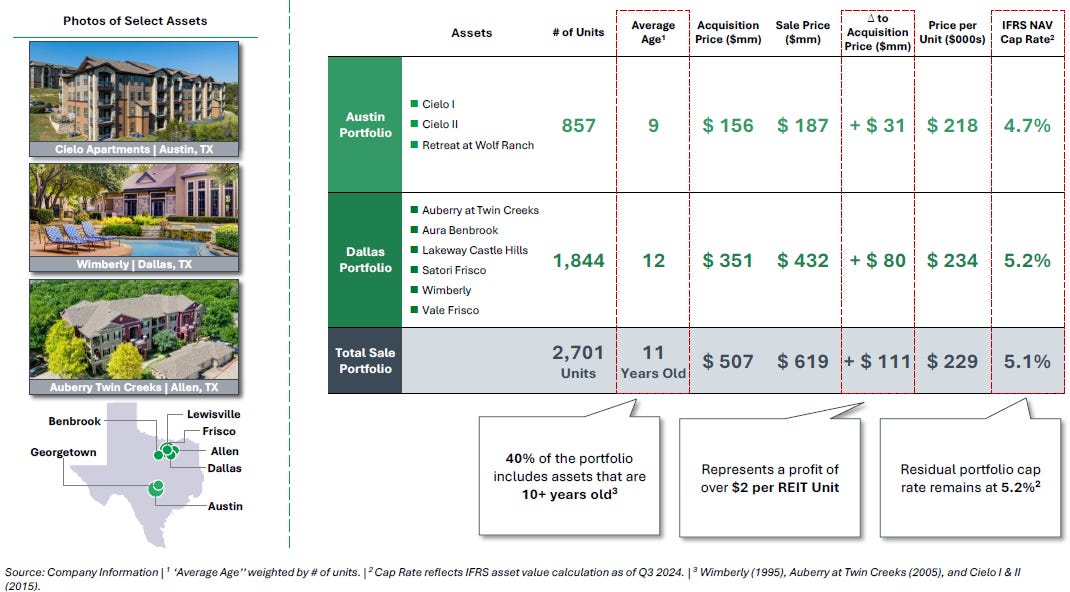

In February 2025, BSR REIT agreed to sell a 9-property portfolio (3 in Austin, 6 in Dallas) in a significant $618.5m transaction to one of the largest multifamily apartments REITs in the US - AvalonBay Communities. This was a significant transaction for BSR, representing about 1/3 of the REIT based on gross asset value.

Overview of BSR / AvalonBay 2025 portfolio transaction

Source: BSR REIT / AvalonBay Transaction Presentation, February 2025

Pricing for the deal was attractive, reflecting $229k per unit and a “high-4s initial going-in cap rate” according to AvalonBay’s CEO at the Citi Global Property CEO in March. This was in-line with BSR’s valuation of the properties (carried out according to IFRS accounting rules) and represented a profit of >20% relative to the REIT’s purchase price of the assets, which were acquired between 2018 and 2021.

What makes the transaction particularly interesting - and transformative - is how it was structured. The three Austin properties were sold in an all-cash transaction for $187m that completed on March 31, 2025. In connection with the transaction, BSR retained $109 million of secured Fannie Mae mortgage indebtedness with an attractive interest rate of approximately 2.7% that was transferred to other assets they own.

The sale of the six Dallas properties was in the form of a “contribution transaction”, which is where things get interesting - and complicated. Consideration was $193m of cash and the exchange of 15 million Class B units for equity in AvalonBay in the form of newly formed “DownREIT” partnership units. This was about 75% of the Class B units outstanding prior to the transaction, which went from representing ~40% to ~15% of the total REIT units outstanding.

Why did the Class B units exist in the first place? They were issued as part of the 2018 IPO to the major investors in the predecessor entity before it was listed, including members of the founding Bailey / Hughes families. They were used to create a tax efficient structure at the time of the REIT IPO, which allowed these legacy investors to defer taxes that would otherwise be paid on a sale. However, as a result, the individual tax positions of the holders of Class B Units are tied to these properties. Selling them directly would create a negative tax outcome. To protect the tax position of the legacy investors, an Investor Right Agreement was put in place, which gave them the ability to nominate 3 board members, and importantly, consent rights over certain fundamental sale transactions provided their ownership interest in the REIT remained above 33%.

This resulted in a great outcome for the legacy investors. By contributing their units for AvalonBay DownREIT units, they trade their ownership in BSR for ownership of a larger, more diversified portfolio while maintaining deferral of taxes. Furthermore, the exchange ratio set with AvalonBay resulted in a valuation of the Class B units of $15.90 per share. This represented a ~6% discount to BSR’s IFRS NAV prior to the transaction but comes at the expense of third-party unitholders as it reflects a significant premium to where BSR’s units were trading at the time (~$12.00 per unit, so a >30% premium).

Most importantly, the investor rights agreement was amended as part of the transaction, and while the legacy investors maintain the right to nominate one director, their consent rights around transactions have been eliminated. This means that the Class B unitholders won’t able to effectively block future M&A transactions that could result in a sub-optimal tax outcome.

This is directly relevant as the “background of the transaction” section of the material change report filed by BSR reveals that AvalonBay’s initial approach to BSR in the summer of 2024 was to acquire the entire REIT through either an all-share or mixed share and cash transaction. This is despite the fact that Houston, which was (and is) BSR’s largest market, is not one of their target “expansion markets”.

We don’t know what price AvalonBay was offering for the whole entity and whether it represented a fair value for the REIT, but based on BSR’s filing the primary obstacle to consummating a deal for the REIT was balancing the tax impact on Class B and public REIT unitholders. With the elimination of the consent rights, this obstacle has been removed. As a result, I believe BSR has become an attractive M&A target for listed multifamily apartment REITs, private operators, or PE firms, especially as fundamentals for US sunbelt apartments are expected to stabilize and improve.

Why is BSR cheap?

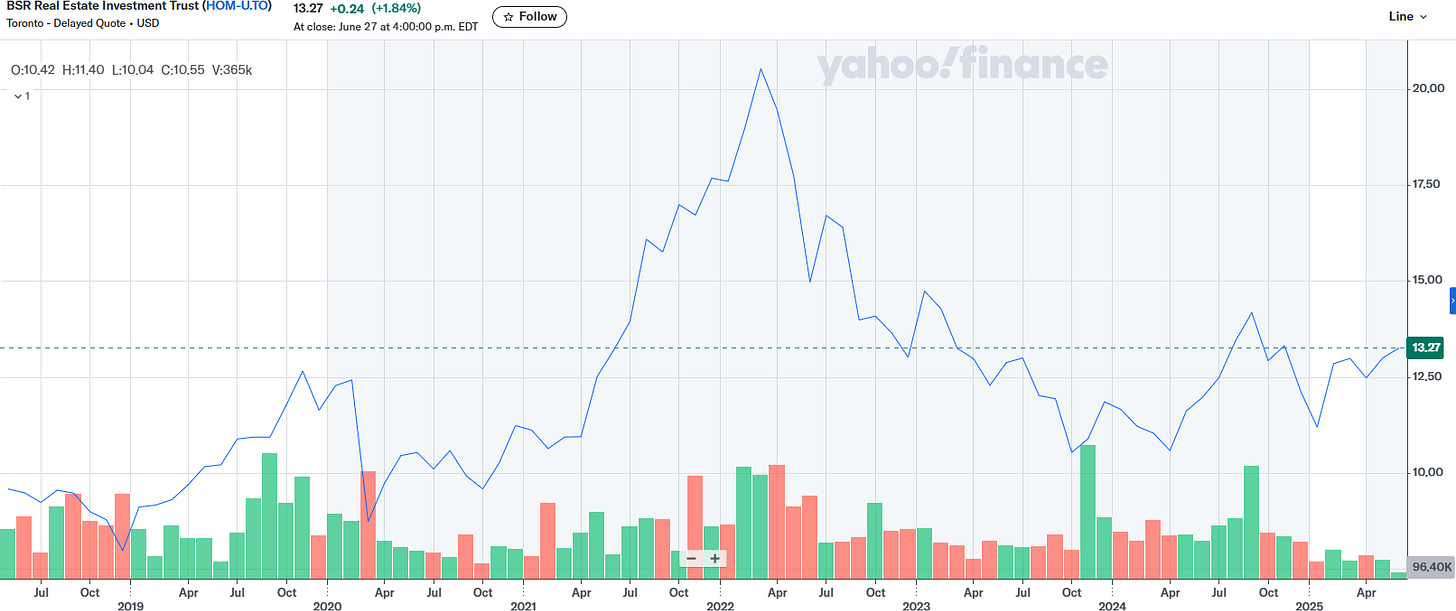

Market reaction to the transaction has largely been a yawn. Units have traded up from their range of ~$12 per unit in early 2025 but have been largely range-bound between $13.00 - $13.30 per unit. I think this is for a couple of reasons.

Source: Yahoo Finance

First, the differential treatment of unitholders to the benefit of Class B unitholders at the expense of third-party public REIT unitholders creates a dark cloud over management incentives. I think the terms of the transaction clearly benefited insiders but looking forward, these protections for Class B unitholders have been removed, which mitigates future differential treatment.

Second, while I see the removal of the consent rights as opening the door to M&A in the future, I would expect many market participants to view the REIT doing a significant transaction that falls short of selling the entire REIT as lowering the take-out odds. Management has highlighted that as a result of these transactions, they will redeploy $190m into new (<10 year old) Class B+ suburban garden-style apartments in their target markets. They’ve wasted no time, acquiring three properties year-to-date in Dallas (1 property) and Houston (2 properties) to the tune of $200m. I think the muted market reaction is in part due to the view that management will be focused on growing the REIT through redeploying disposition proceeds rather than selling the company in the short-term.

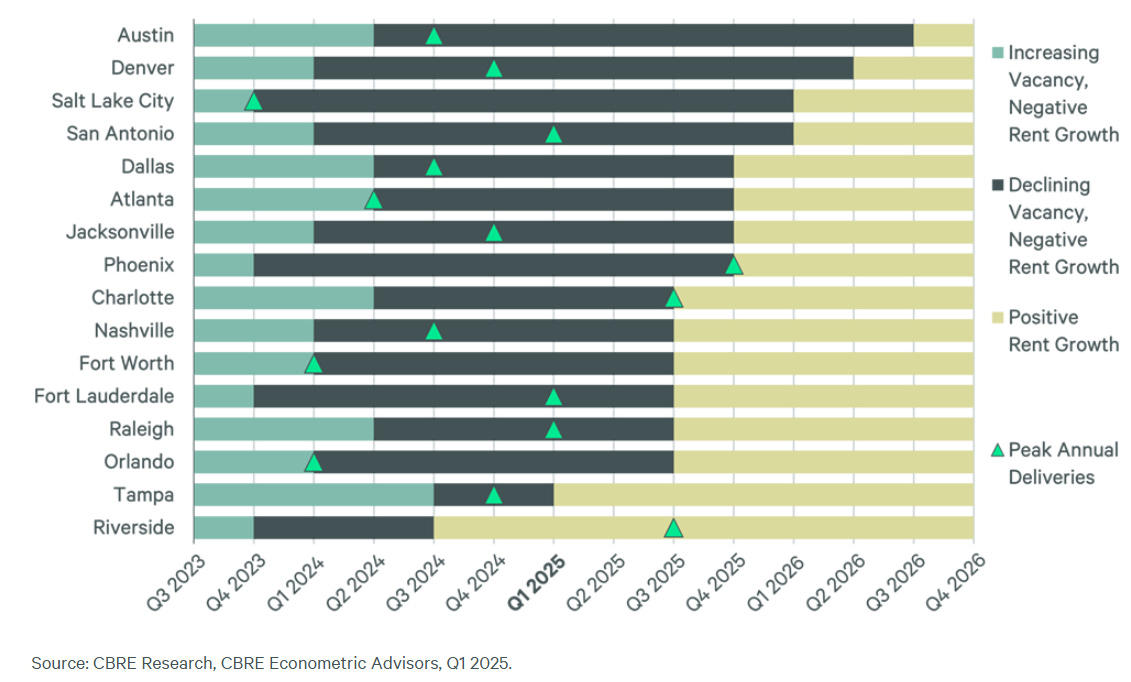

Third, fundamentals in BSR’s markets continue to be affected by the significant wave of new supply that was constructed in 2023 and 2024. Austin in particularly, has seen a massive wave of new development, which has led to widely-publicized declines in rents. While supply under construction has fallen significantly, there remains a large number of newly-built apartments that are leasing up through 2025 and likely into the first half of 2026, that will slow any rent growth.

Lastly, BSR is a small REIT with limited liquidity that owns US properties listed in Canada. Liquidity in the units is limited with ~$100k of the US denominated units trading per day, and has declined over the last couple years. Analyst coverage is limited to Canadian banks. As a result, I believe BSR flies under the radar of most REIT investors.

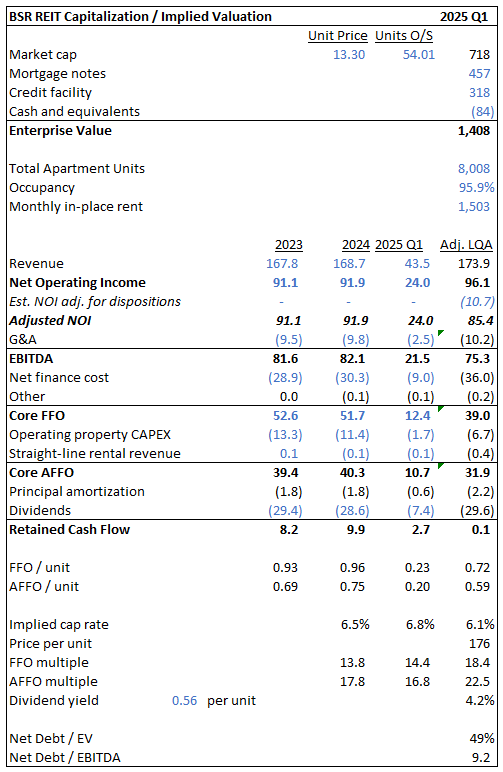

What’s it worth?

At $13.30 per unit, BSR trades at an implied cap rate of 6.1% based on 2025 Q1 NOI adjusted for the Austin and Bluff Creek dispositions, which completed at the end of the quarter. The implied price per unit is $176k with FFO multiples of 18x and 22x (again adjusted for the sales during the quarter). They pay a monthly dividend that results in a 4.2% yield.

On the face of it BSR doesn’t screen particularly cheap on a cap rate / FFO basis and is unlikely to do so for the next several quarters as disposition proceeds are reinvested into property acquisitions and their Austin development continues to lease up.

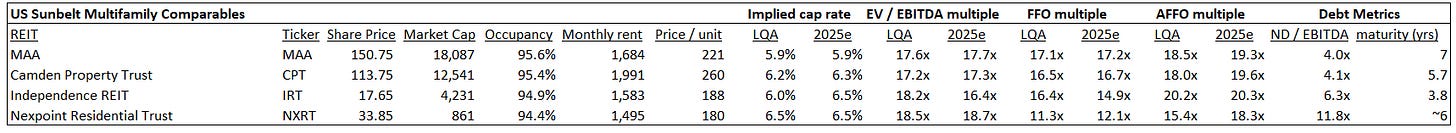

US sunbelt multifamily peers trade at 6% - 6.5% implied cap rates and 18x - 20x AFFO. The implied valuation per unit is where BSR REIT stands out as it trades at a discount to even Nexpoint Residential Trust, which focuses on value-add Class B properties and operates with high leverage compared to the peer set and a 20% - 30% discount to the “blue chip” REITs in the space - MAA & Camden Property Trust.

Adjusting for the Dallas / Fort Worth contribution transaction, which closed in April, BSR is even cheaper on a price per unit basis with an implied valuation of $164k per unit. This is before accounting for two Houston acquisitions which closed in Q2 and were at $220k per unit (average age of 2 years), in-line with their acquisition of a property in Dallas at $220k per unit (8 years old).

I estimate that BSR REIT’s portfolio is worth $1.6bn based on a ~5.5% cap rate and valuing recent acquisitions and properties in lease-up at cost. This equates to ~$205k per unit and results in a NAV per share of ~$17.30. The current share price of $13.30 reflects a 23% discount to NAV. I think this price would reflect an attractive acquisition cost basis for a larger REIT or private equity group as it reflects a discount to replacement cost and comparable transactions.

I have assumed a higher cap rate for the remaining portfolio than the headline transaction prices for the BSR / AvalonBay transaction, which was at a weighted average 5% cap rate. Another recent comparable was Camden Property Trust’s acquisition of a newly-built apartment property in lease-up in the Austin suburb of Leander (85% occupied). Camden paid ~$190k per unit and a “stabilized yield of 5%”.

While a different sunbelt market, Equity Residential paid a “high-4% in-place cap rate / low-5% pro forma cap rate) and $260k per unit for a portfolio of suburban Atlanta apartments in Q2. Looking at replacement cost, BSR’s Austin development completed construction at a cost of ~$269k per unit in Q4 2024 and MAA acquired a Dallas property in lease-up for $274k per unit.

I think a mid 5% cap rate and ~$200k per unit would be an attractive price for an acquiror to pay, especially if / when fundamentals continue to improve. While BSR is not significantly cheaper than peers on a cash flow basis, leverage provides a double-edged sword. It increases risk if values fall but also creates more “torque” to the upside in a M&A transaction or take-private, which in my opinion makes BSR an interesting US sunbelt apartment REIT to own.

Management and capital allocation

BSR’s management have proven to be capable investors and operators. The current CEO and COO have worked for BSR and together for many years. They were CIO and CFO respectively at the time of the IPO when John Bailey, of the Bailey Properties family, was CEO. Current management reflects a degree of “changing of the guard” as no member of the founding Bailey / Hughes families is in the C-Suite. A new CFO joined this year, who was formerly a Wells Fargo real estate investment banker.

A couple of recent data points supports management’s competence in acquiring, operating, and selling multifamily real estate.

First, at a high level, the AvalonBay portfolio disposition generated attractive returns with the headline price of $618.5m reflecting a gain of $111m or over 20% vs. BSR’s purchase price for these properties. These assets were acquired between 2019 and 2021, which was a period of aggressive pricing for sunbelt multifamily apartments so cap rate compression has not been the primary driver of returns.

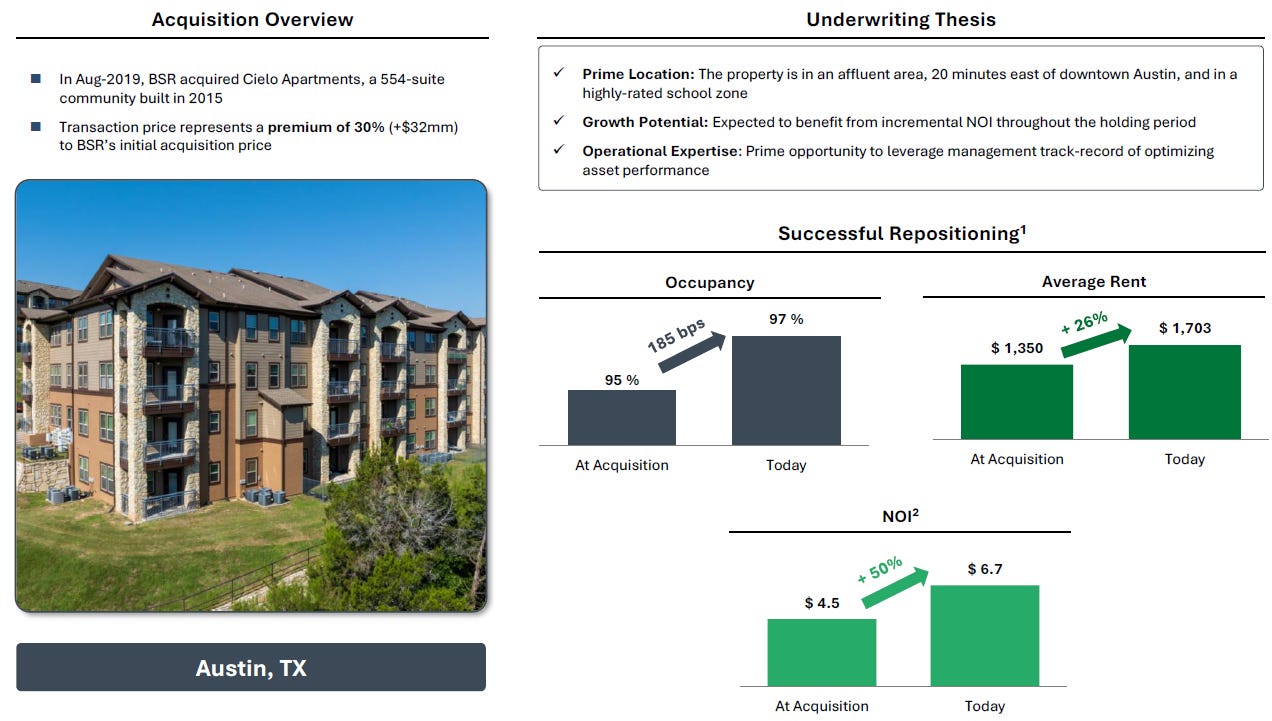

A good case study is the Cielo I & II apartments in the Austin MSA sold as part of the portfolio transaction. BSR acquired the properties for ~$104.5m in August 2019. This reflected ~$190k per unit and a ~4.3% cap rate. As part of the portfolio disposition, the properties were valued at ~$136.5m, ~$245k per unit, and a ~4.9% cap rate. Despite a ~50 bps spread between exit and entry cap rate, BSR achieved ~30% capital value growth over a five and half year hold period (~5% per annum). BSR paid a full market price but generated good returns by buying a quality assets that has benefitted from strong rental growth in Austin over the period and has also been able to maintain occupancy at a high level despite the rise in competing supply over the past 18 months.

Source: BSR REIT / AvalonBay Transaction Presentation, February 2025

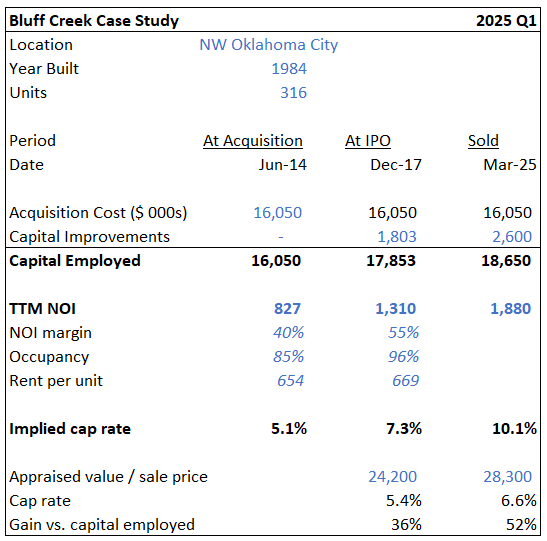

BSR also sold a property in the Oklahoma City MSA in Q1 that provides another good “round trip” case study we can use to evaluate managements ability to add value as it was also featured in their 2018 IPO prospectus. BSR acquired the property in 2014 for $16m and implemented a $2.6m capital improvement program to renovate units and common areas, $1.8m of which was complete by the 2018 IPO.

At the time of the IPO they increased NOI by ~58%, supporting a 7.3% yield on cost and ~35% increase in the appraised value vs. capital employed. Between Dec 2017 and March 2025, when the property was sold, BSR increased NOI by an additional ~43% (which represents a ~8% CAGR over the ~10 years since acquisition) and a ~10% yield on cost. The property was sold for $28.3m, which reflected a ~50% gain relative to the capital employed, 17% gain since the IPO valuation, and ~4% annual capital value growth over the ~10 year hold period.

In addition to being capable acquirors and asset managers, management has also demonstrated pretty rational capital allocation. They have issued equity to grow when trading at high FFO / AFFO multiples and a premium to NAV but have not been afraid to shrink the enterprise and buyback shares rather than acquire properties when trading at a discount.

Since the 2018 IPO at $10 per unit, BSR raised $110m in September 2019 and February 2021 in follow on offerings at between $10.60 and $11 per share. They then took advantage of the post-COVID boom in sunbelt multifamily apartment REIT stock prices to raise $115m in April 2022 at $19.55 per share. By Q4 2022, BSR had reversed course and were repurchasing shares. They bought back ~4.6m shares in Q4 2022 and over the course of 2023, representing about 8% of shares outstanding, at $11.50 per unit.

Outlook, catalysts and risks

Stabilization of operating fundamentals in their markets, particularly Austin. While we’ve passed peak deliveries in all of BSR’s markets, lease-up of newly-developed properties continues to weigh on occupancy and rents.

Source: BSR REIT Second Quarter 2025 Operational Update

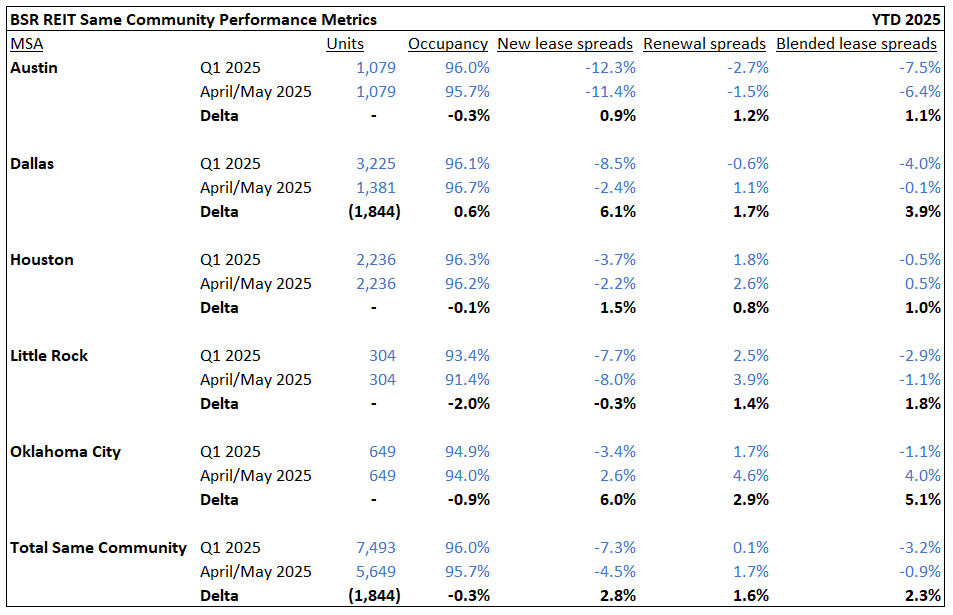

So far in 2025, BSR’s portfolio has managed to maintain relatively high occupancy and there has been some sequential improvement in lease spreads in April / May 2025 compared to Q1. Notably, blended spreads turned positive in Houston and Oklahoma City and show signs of stabilizing in Dallas / Fort Worth. New lease spreads remain negative in every market except for OKC.

A CBRE analysis of high-supply US multifamily markets indicates they expect Dallas / Forth Worth to start to see positive rental growth from Q4 2025 and from Q3 2026 in Austin. While there’s no guarantee rents will stabilize and return to growth in the next 12 - 18 months, I think there’s a good chance they do, which will flow through to BSR’s results and strengthen investor demand and pricing for multifamily properties in their markets.

BSR is continuing to simplify and upgrade the quality of their portfolio, which will make it more attractive to potential acquirors. In addition to the disposition of Bluff Creek in Q1, BSR listed their Little Rock portfolio of three assets for sale, which is currently under contract. I anticipate they will also sell their remaining Oklahoma City properties in the next year or so. This will enable them to continue rotating out of older properties in lower-tier markets into newer, Class B+ / A properties in Austin, Dallas / Fort Worth, and Houston. These assets remain in high demand, have seen pricing stay surprisingly resilient despite challenging market conditions, and I believe will make BSR a more attractive M&A target.

A key risk is high leverage relative to listed peers and significant near-term debt maturities. BSR’s net debt represents ~50% of enterprise value and approximately 9.2x EBITDA. These metrics don’t reflect distress - and in fact are in-line with how a private market leverage metrics - but REIT investors, particularly in the US, are put off by leverage in excess of 6.0x net debt / EBTIDA.

Only about 10% of the ~$775m in debt ($318m drawn on a credit facility secured by 12 properties and $457 of mortgages) matures in the next 12 months but the weighted average term is only 2.7 years. I don’t foresee significant challenges refinancing debt as EBITDA reflects ~2x debt service coverage but contractual interest rates are low - 3.8% as of Q1 2025 - and are likely to rise upon refinancing, impacting cash flow.

A significant downturn in the economy affecting wages and employment is probably the most material downside risk. Demand for apartments has been surprisingly strong in 2025 so far supported by healthy wage growth and the high cost of homeownership due to high mortgage rates. However, apartment rents and occupancy could be under significant pressure if demand reverses in BSR’s core markets while they continue to work through the high number of newly-developed properties in lease-up.

Great Analysis!

However, I think you portray the negotiations with AVB and disclosures about the deal complications too optimistically. BSR explained that AVB's offer for the whole REIT was "significantly below the REIT’s IFRS NAV per Unit". The transaction did not remove the adverse tax complications from sale of appreciated US assets and they would reduce the value realizable in any future transaction.

"an all-stock transaction was unlikely to be attractive to the REIT Unitholders

because it would be taxable"

"an all-cash transaction would result in significant capital gains taxes

to the REIT and its unitholders"

Thanks for the thorough and current coverage of this REIT. I had paid no attention since shortly before the AVB offer. As a retiree who cares greatly about sustaining income, the risk to the dividend from leverage this high keeps me away.