Abrdn European Logistics Income plc (ASLI.L)

European Industrial / Logistics REIT liquidation, 15% discount to NAV and 12-18 month timeline

Summary

European industrial / logistics REIT liquidating its portfolio after failing to find a portfolio buyer in strategic review that ended in May 2024.

Capital markets environment has improved significantly since with falling rates and lower cost of debt capital reaching ~4% for European industrial / logistics.

Blackstone and Brookfield both participated in separate ~€1 billion M&A transactions for European industrial / logistics portfolios in Q4 2024 at pricing of ~5% net initial yield.

ASLI Shares trade at a ~15% discount to my estimate of net liquidation proceeds (based on a 5.1% net initial yield) for a 12% - 18% IRR assuming a 12-18 month wind-down timeline (20% - 30% IRR if properties are sold in-line with balance sheet valuations).

Nine out of 25 properties in the market and manager is incentivized to liquidate portfolio efficiently and achieve sales proceeds in-line with balance sheet valuations due to revised fee structure.

Background

ASLI is an externally-managed REIT listed in the UK, which exclusively owns industrial / logistics property in continental Europe. The trust went public in 2017 in a period in which interest rates were low and European logistics property fundamentals were strong. This positive environment intensified during COVID but then reversed as the rapid rise in interest rates in 2022 impacted property values and investor demand for commercial real estate.

Fast forward to late 2023, the business never really achieved scale, they were paying an uncovered dividend, leverage was rising, and they were trading at a perennial discount to NAV. The share price has fallen ~45% from June 2022. They announced a strategic review in November 2023, which concluded in May 2024, with them failing to find a buyer for the entire portfolio at a sufficiently attractive price but announcing a “managed wind-down” of the portfolio.

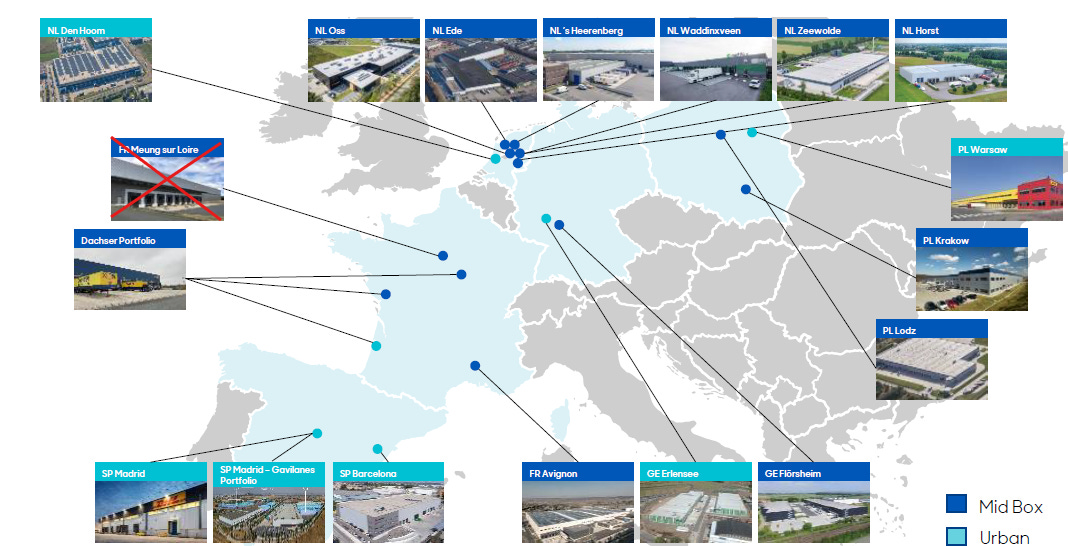

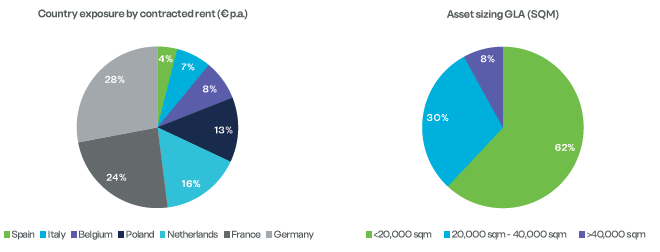

Their portfolio consists of 25 properties comprising 0.5 million square meters across 5 European countries with roughly a third in the Netherlands, a third in Spain, and the remainder in Poland, France, and Germany. The assets are predominantly new, well-leased (~95% occupied) with a weighted average unexpired lease term (WAULT) of 6.5 years (to first tenant break option).

Why does this opportunity exist (and why now)?

A small cap REIT that runs a strategic review and fails to find an acquiror for the entire portfolio should give an investor pause. Liquidating a portfolio asset-by-asset or in smaller sub-portfolios is a longer—and as a result, more costly—exercise for shareholders.

However, I can understand why this portfolio of assets might not be particularly attractive as a package and why, as management cited in the conclusion of the strategic review in May 2024, the “significant majority of interested parties” expressed a preference to acquire assets within certain geographies or individual assets. I also believe that the real estate capital markets environment has improved for European logistics and there have been key asset management initiatives that have improved the attractiveness of the assets to potential buyers.

Portfolio is a “mixed bag” of geographies and logistics real estate product types. It’s about evenly split between more stable Western European markets (Netherlands, France, Germany) and emerging Southern and Eastern European markets (Spain, Poland). It is a mix of mid-box regional logistics and urban logistics properties, multi and single-let, and uses, from cross-docked parcel terminals to climate controlled food storage.

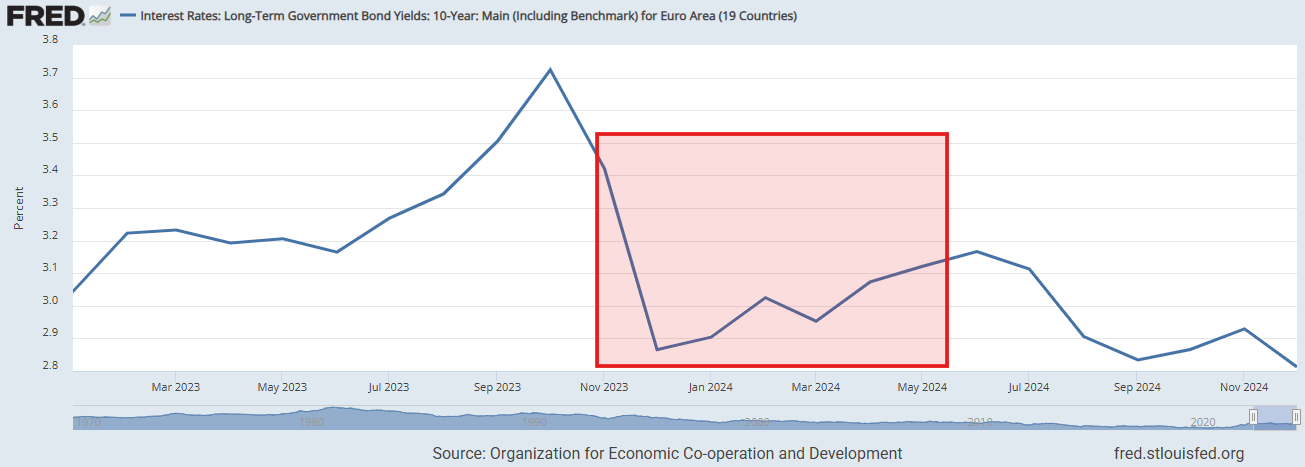

European rates and cost of debt capital for real estate has fallen. Long-term European government yields fell at the end of 2023 when the strategic review was announced (review period in the red box above) but proceeded to rise through the review process. They’ve since fallen to new lows. Rate cuts by the ECB and market expectations for yields has also resulted in lower borrowing base rates with 5-year EURIBOR swaps falling ~25bps year-on-year to ~2.3% today. Loan margins for core logistics real estate have also compressed from ~180 in 2024 to ~160 bps today putting all-in cost of debt for good quality European logistics real estate at around 4%.

Another data point on the falling cost of capital in Europe, while not specific to real estate, is that the high-yield bond index—which represents a similar-ish yield alternative to commercial real estate—has fallen about 100bps from 6.00% - 6.25% during the review period to 5.00%-5.25% today.

Significant progress has been made leasing up space vacated by a tenant that went into administration at their largest asset (which comprises 7 properties) in Madrid. Arrival, an electric vehicle manufacturer, occupied three units totaling 27,165 square meters, was in financial difficulty, and ceased paying rent in late 2023. ASLI negotiated a surrender of the lease in February 2024. One of the units (~20% of the space) was let during the strategic review process to a new occupier but since the end the process, they have upsized an existing tenant at the property to take 16,500 square meters (previously occupied 7,718 square meters) and backfilled the space they formerly occupied to a new tenant. Two units at the property remain vacant - a 5,534 square meter unit vacated by Arrival and a larger, 11,264 square meter unit vacated by Amazon in August 2023 (Amazon also occupy the largest unit at the property on a long-term lease with WAULT in excess of 12 years).

European logistics real estate M&A activity in H2 2024 supports improving environment

In September 2024, Blackstone acquired an 80% interest in a pan-European industrial / logistics portfolio owned by Burstone. The recapitalization of this portfolio was motivated by upcoming debt maturities in 2025 and Burstone’s desire to transition to towards a less capital intensive / asset-light business model.

The portfolio is similar to ASLI’s albeit with a larger weighting to Germany. As of September 2024, occupancy was ~97% and the WAULT was 4.9 years. The nature of the transaction, in which an LP interest is sold and Burstone remain as JV partner and GP, charging a management fee, likely means the trade was at a discount to what the portfolio would sell for on a free and clear basis.

The transaction valued the 32-property portfolio at €1.0 billion or €910 per square meter, a 3.1% discount to their balance sheet valuation (which was based on a weighted average 5.1% cap rate). The portfolio generated net property income of €26.4m in the 6 months to September 2024, which represents a 5.2% cap rate on the implied transaction value or a 4.9% net initial yield if purchase costs of 5.5% are assumed (typical for European property valuations).

In November 2024, Brookfield acquired Tritax Eurobox in an all-cash offer, beating out a competing, share-based offer from Segro PLC. This was a larger, also externally-managed REIT listed in the UK that owned European logistics properties and faced similar difficulties to ASLI - trading at a discount to NAV with elevated leverage.

The portfolio is focused on newer, large “big box” properties, predominantly in Germany, the Netherlands, and Belgium (~60% of the portfolio). The WAULT to expiry is 9.5 years but 7.8 years to first tenant break option. Due to the larger size of the properties, one would expect them to sell for a lower price on a per square meter basis.

The transaction valued Tritax Eurobox’s 21-property portfolio at €1.3 billion or €880 per square meter, a 10% discount to the balance sheet valuation of their portfolio in March 2024 (based on a weighted average 4.65% net initial yield). The purchase price reflected a 5.1% net initial yield.

Brookfield subsequently agreed to sell 6 of the properties to underbidder Segro. These properties are located in Germany and the Netherlands and were sold for €470m or €1,275 per square meter at a 4.7% net initial yield. This implies pricing of 5.3% NIY and €750 per square meter for the remaining portfolio, now ~30% Germany and Belgium and ~70% in Spain, Italy, Sweden, and Poland.

Valuation and potential liquidation proceeds

Based on a current share price of £0.57, which is equivalent to €0.68 (share price and FX rate as of Jan 23, 2025), ASLI’s market capitalization is ~€280m and enterprise value is €500m adding debt of ~€250m and cash of ~€30m. With net rental income of €14.3m in H1 (€28.6m annualized), this implies a net initial yield of 5.4% and €970 per square meter for their portfolio. Adjusting for non-recurring strategic review costs of €1.5m in H1, annualized funds from operation are €17.4m resulting in a 16.0x price / FFO multiple.

Taking into account leasing activity and inflation-linked rent increases post period end, I estimate that the portfolio generates an annualized net rental income of €30.6m. Applying a weighted average net initial yield of 5.1% and assuming 5.7% purchase costs (in line with those assumed for their balance sheet valuations) results in a market value for the portfolio of €570m, which reflects €1,100 per square meter. These valuation metrics are in-line with the recent Blackstone / Burstone and Brookfield / Tritax Eurobox transactions.

My market value estimate is an 8% discount to the balance sheet valuation of the portfolio (excluding the wind-down costs) of ~€620m. The majority of the discount is attributable to their portfolio in Spain, where I have a less optimistic view on asset values and logistics fundamentals. My valuations of their French and Polish assets are also more conservative.

Deducting debt of €250m, wind-down costs, which include the agree disposal fee structure for the manager, and accounting for cash and other assets / liabilities indicates a net asset value / liquidation value of €330m or €0.80 per share. This reflects a discount to balance sheet net asset value (which is €0.876 including wind-down costs) of -9%.

My market value estimate for the properties reflects a 15% discount to their original purchase price, which might not seem like all that much given the significant recent move in rates and property values. Looking at their pre-COVID acquisitions (2018-2020), I think values are broadly up, due to rental growth and broadly similar net initial yields. I see market values being 20% - 40% below their purchase prices for assets in 2021 and 2022, where in retrospect, they clearly overpaid (by a lot).

Green Street’s Pan-European CPPI report broadly supports this price evolution over time with current industrial values down ~20% from their peak in 2022 but higher than the 2018-2020 period.

Potential proceeds and timeline

My NAV estimate indicates ~18% upside from the current share price. At the conclusion of the strategic review process, management indicated that they believe the majority of the assets can be disposed of in 2025. The Q3 2024 update in November 2024 indicated they have commenced sales processes for 6 assets and in advanced stages of 3 of those, with LOIs anticipated to be signed “shortly”. Sales processes for a further 3 assets were to commence in January, which would mean that 9 of their 25 properties are in the market.

I think a 12-18 month timeframe from here is a realistic target. This would result in a 12%-18% IRR based on my net asset value estimate, with upside from retained cash flow prior to assets being sold - currently about €0.01 per share per quarter or ~1.5% of the current share price. If they are able to sell the portfolio in line with their balance sheet valuations, this would result in a 20% - 30% IRR over 12-18 months.

As part of the managed wind-down, the investment management agreement was revised to lower the asset management fee to 50 bps of NAV (from 75 bps) and adds a disposal fee. The disposal fee is 65 bps of net disposal proceeds payable in two installment: an initial payment once 80% of the portfolio value of as of March 2024 is sold, and the remainder once 100% of the properties have been sold.

The manager will also receive a conditional disposal fee of 5 bps if aggregate gross sales values is at least 95% of the March 2024 portfolio value and 10 bps if net disposal proceeds exceed the March 2024 portfolio value. The March 2024 portfolio value was €602.7m, which reflects a slight discount to current balance sheet valuation (after deducting the assumed wind-down costs) and a ~5% premium to my market value estimate.

This fee structure isn’t perfect but it does a reasonable job of aligning incentives and motivate the manager to sell the portfolio quickly but not at firesale prices.

Annual report released today, updates in a note: https://substack.com/@realassetsvalue/note/c-107998173?utm_source=notes-share-action&r=ogi7p

Given the update from the company today (the day after I wrote the post and before I published it - life comes at you fast), I wrote an update note: https://substack.com/@realassetsvalue/note/c-88318030